Key Takeaways

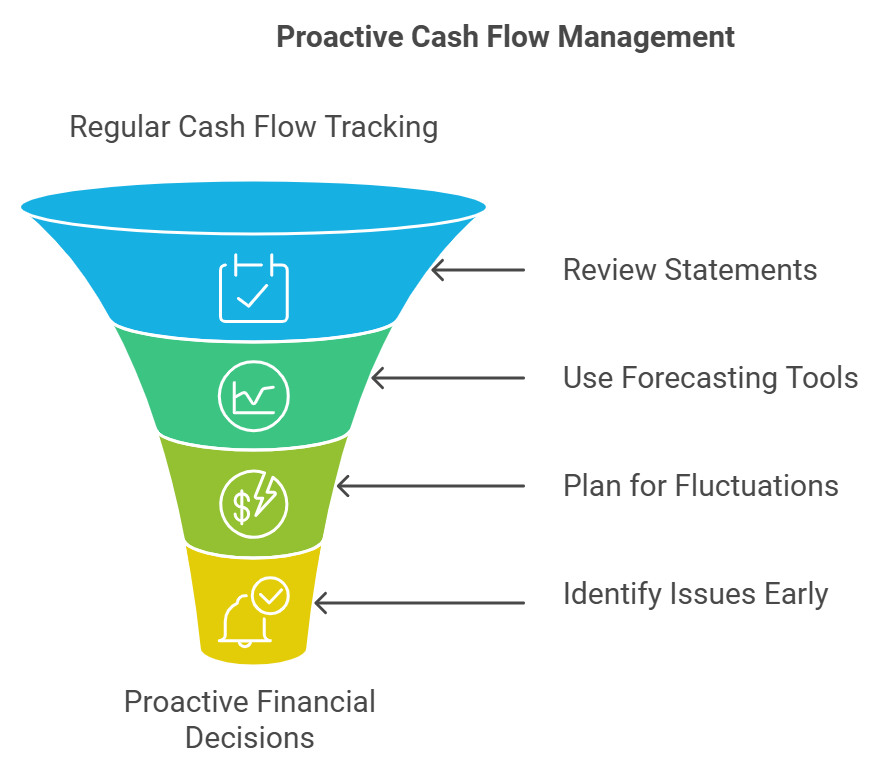

- Monitor and forecast cash flow regularly to identify potential issues early.

- Negotiate payment terms with customers and suppliers to align cash inflows and outflows.

- Use technology to streamline invoicing, payment collection, and inventory management.

- Build a cash reserve to handle unexpected expenses or slow seasons.

- Avoid over-reliance on credit and plan for seasonality.

What is Cash Flow?

Cash flow refers to the movement of money into and out of a business. It represents the inflows (money received) and outflows (money spent) within a specific time period.

Maintaining a positive cash flow is crucial for a business’s survival and growth, as it ensures that the business can cover its expenses, invest in operations, and sustain itself during financial challenges.

A wholesale business sells $50,000 in products but offers customers 60-day payment terms. While the profit might be positive, cash flow could be negative if the business doesn’t have enough cash on hand to pay immediate expenses like supplier bills.

Types of Cash Flow

- Operating Cash Flow:

- Money generated from the core operations of the business.

- Example: Revenue from selling products minus operational costs.

- Investing Cash Flow:

- Money spent on or earned from investments.

- Example: Purchasing equipment (outflow) or selling unused assets (inflow).

- Financing Cash Flow:

- Money related to financing activities, such as loans or equity investments.

- Example: Borrowing funds (inflow) or repaying loans (outflow).

Positive vs. Negative Cash Flow

- Positive Cash Flow:

- When inflows exceed outflows, your business has more cash available to cover expenses, invest in growth, or save for the future.

- Example: A wholesale distributor receives $50,000 in customer payments but only spends $40,000 on expenses, leaving $10,000 in positive cash flow.

- Negative Cash Flow:

- When outflows exceed inflows, the business may struggle to meet financial obligations or need external funding.

- Example: A business spends $60,000 on inventory and salaries but only receives $45,000 in payments, resulting in a $15,000 deficit.

1. Monitor and Forecast Cash Flow

Tracking cash flow regularly allows you to identify potential shortages or surpluses in advance.

Example: A wholesale electronics supplier identified a cash crunch three months in advance, allowing them to secure a short-term loan proactively.

2. Negotiate Better Payment Terms

Your payment terms with customers and suppliers significantly impact cash flow.

- With Customers:

- Offer incentives for early payments, such as a 2% discount for payments made within 10 days.

- Set up automated reminders for overdue invoices.

- With Suppliers:

- Negotiate extended payment terms to align with your receivables.

- Build strong relationships to request flexible payment plans during slow periods.

Example: A furniture wholesaler extended supplier terms from 30 to 45 days, aligning with their customer payment cycle and avoiding cash shortages.

3. Streamline Inventory Management

Overstocking ties up capital, while understocking can lead to missed sales opportunities.

- Inventory Management Tips:

- Use inventory management software to analyze sales trends and adjust stock levels.

- Prioritize high-demand, high-margin products.

- Conduct regular inventory audits to identify slow-moving items.

Example: A wholesale food distributor reduced storage costs by 20% by switching to a just-in-time (JIT) inventory model.

4. Diversify Revenue Streams

Relying on a single product category or seasonal demand can lead to cash flow fluctuations.

- Strategies:

- Add complementary products to your catalog to boost sales throughout the year.

- Explore new markets or industries to reduce dependence on a single revenue stream.

Example: A wholesale packaging supplier began offering eco-friendly alternatives, attracting new customers and increasing revenue by 15%.

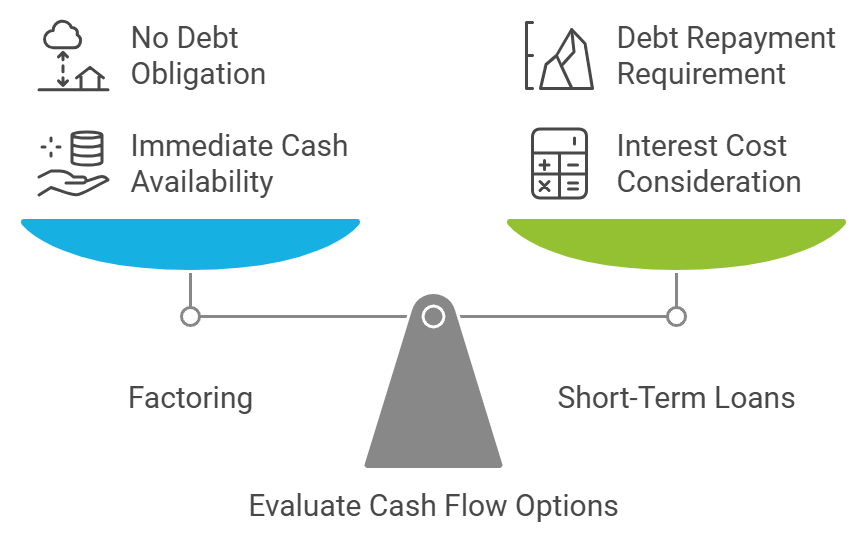

5. Leverage Factoring or Financing

If customers take too long to pay, consider alternative financing options to improve cash flow.

- Options:

- Factoring: Sell your receivables to a factoring company for immediate cash.

- Short-Term Loans: Use lines of credit or working capital loans to cover temporary gaps.

Example: A wholesale clothing supplier used factoring to access cash tied up in receivables, allowing them to purchase inventory for a large seasonal order.

6. Implement Automated Billing and Payment Systems

Manual invoicing and payment collection can cause delays.

- Automation Benefits:

- Send invoices promptly and reduce human error.

- Set up automated payment reminders for customers.

- Offer multiple payment options, such as ACH transfers and credit cards.

Example: A wholesale hardware business reduced overdue payments by 30% after introducing automated invoicing software.

7. Maintain a Cash Reserve

Building a cash reserve helps cover unexpected expenses or seasonal downturns.

- How to Build a Reserve:

- Set aside a percentage of monthly profits.

- Gradually grow the reserve to cover at least three months of operating expenses.

Example: A wholesale stationery business used its cash reserve to cover supplier payments during a slow holiday season, avoiding late fees.

Common Mistakes to Avoid

1. Over-Reliance on Credit

While credit can be useful, overextending can lead to debt-related challenges.

- Tip: Use credit sparingly and ensure you have a repayment plan aligned with your cash flow.

2. Ignoring Seasonal Trends

Failing to plan for seasonality can lead to cash shortages.

- Tip: Analyze historical sales data and adjust inventory and marketing strategies accordingly.

3. Poor Communication with Stakeholders

Lack of transparency with customers and suppliers can result in delayed payments and disrupted supply chains.

- Tip: Maintain open communication and set clear expectations.

Tools and Technologies for Cash Flow Management

Recommended Tools:

- Accounting Software: QuickBooks, Xero for tracking inflows and outflows.

- Inventory Management: TradeGecko, Zoho Inventory for stock optimization.

- Forecasting Tools: Float, Pulse for predicting future cash flow needs.

Real-Life Examples

Success Story: Navigating Seasonal Fluctuations

A wholesale gardening supplies company faced slow winter sales. By forecasting cash flow and negotiating extended supplier terms, they maintained smooth operations and avoided financial stress.

Failure Story: Lessons from Poor Cash Flow

A small wholesale furniture business overstocked inventory without considering cash flow, leading to missed supplier payments and eventual business closure. This highlights the importance of regular cash flow monitoring and inventory management.